You'll notice that the score table in this guide is no longer displaying. This is because the guide is over 5 years old and the scores were out of date. We have a programme of reviewing guides to schedule updates and this one is under consideration.

The market for edible oils is expanding. The five most popular types of oil are vegetable, rapeseed, sunflower, coconut and olive oil.

Vegetable/rapeseed and olive oils are bought by about four in ten people, while a third buy sunflower oils. Demand for coconut oil has grown rapidly in recent years, although it is still only purchased by 7% of consumers. 2017/18 saw demand dip slightly, although only time will tell if this is a trend.

Olive oil brands in the guide

The supermarkets have a strong presence in the olive oil market, their own brands collectively holding 53% market share. The two non-supermarket brands that dominate the market are Filippo Berio, owned by the Bright Food Group, and Napolina, owned by Mitsubishi. Those that top our table are generally smaller brands, which, if you cannot find at your local wholefood shop, can usually be bought online.

We recommend you buy organic olive oils, and organic oil is common in the olive oil market, so there is plenty to choose from, with around half of the big supermarkets offering organic own-brand choices too.

Olive oil production

The UK produces no olives of its own and relies solely on imports. In 2001, the value of olive oil imports to the UK was worth £57m; but, by 2017, this had increased to £219m, although some of this is price inflation, with 2017 seeing olive prices spike due to droughts that affected major producer countries across the Mediterranean. Brexit, should it occur, will likely increase olive oil prices still further.

The Mediterranean basin is home to about 95% of the olive trees in the world, so production of olive oil stems primarily from southern Europe, North Africa and the Near East. EU countries account for 70 to 75% of world production of olive oil, with Spain providing 59% of the EU total in 2017, followed by Italy (25%), Portugal (7%) and Greece (7%). Olive oil has been produced in and around the Mediterranean for thousands of years. Production is generally categorised into three methods: traditional or extensive, semi-intensive, and super-intensive.

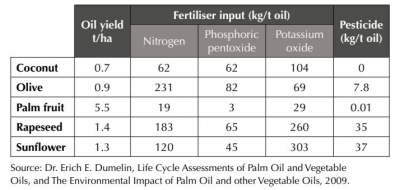

Traditional methods of production are characterised by low levels of labour and agricultural inputs, such as water, pesticides and fertilisers, and low tree density. Intensive or super-intensive olive farming generally consists of several factors: high-density plantation (up to 2500 trees per hectare), generally located on flat areas; high inputs of fertilisers and pesticides; huge water inputs and irrigation systems; and the mechanisation of pruning and harvesting.